Embarking on the journey as a Chair for the first time marks a momentous milestone in any career. The responsibilities and challenges that come with this position are unique and require a delicate balance of leadership, collaboration and strategic thinking.

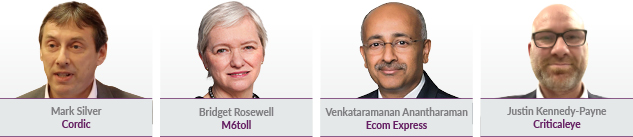

When considering the leap into a Chair role, there is a lot to consider, such as chemistry with the CEO and the ownership structure of the business, not to mention overall financial performance. Mark Silver, Chair of Cordic and Board Mentor at Criticaleye, commented: “As a private equity Chair, you're going into this knowing a company will be sold. It might be sold in two years’ time. It might be sold in seven years’ time, but ultimately you're in the investment for a limited period.”

A clear awareness of the shareholders and investors, such as the difference between those in a PE owned business as compared to a publicly listed one, is important. Bernie Waldron, Chair of Edgescan and also a Criticaleye Board Mentor, remarked: “Having tried both, I concluded that the way private equity-backed companies and Boards operated suited my own personal style and strengths. In a public company environment, the shareholders are normally fragmented with a mix of institutional and retail investors. In private equity, they’re concentrated on the Board, so they know everything that is going on, warts and all.

“On average, most Chairs and NEDs in a public company environment will spend more time on checks and balances, compliance and communicating to the market. This is important and inevitable because in a plc, the Board is the conscience of the company on behalf of all shareholders.”

People First

Any due diligence that can be conducted before taking up a Chair position will be beneficial not only to get a sense of business performance, but also its overarching culture.

Bridget Rosewell, Chair of M6toll, noted: “The Chair and CEO is the most important relationship. If it goes wrong, the business will go wrong. All the energies of the business will be absorbed in the battle between the Chair and chief executive [and] if that situation develops, then one or the other must go.”

It’s essential to have regular check-ins. Venkataramanan Anantharaman, Chair of Ecom Express and another Board Mentor at Criticaleye, recommended meeting with a CEO “at least once every two to three weeks” and to make it a “meaningful chat for at least an hour”.

Justin Kennedy-Payne, Business Development Manager at Criticaleye, said: “Trust is the secret ingredient for any first-time Chair if they’re going to be successful in the role. It’s by building a close relationship with the CEO, as well as others across the organisation, that a Chair will be able to get the right balance between support and challenge in the key areas around strategy, performance and governance.”

Bernie explained: “I place great importance on the potential relationship with the CEO. I want to try to understand whether their psychometric make-up will allow us to have a constructive, robust, but open relationship, where as a Chair I’m able to challenge them and for us both to know it’s a psychologically safe space.”

It’s through building relationships that a Chair will get a more rounded understanding of an organisation. Bridget explained that arguably the most challenging aspect for a new Chair is getting to grips with the intangibles. She said: “Quite often, there are people pulling an organisation together, but they're down in the weeds. So what's the bit that people take for granted? What's the bit that somebody else would have a very different perspective on? What's the bit that's invisible? It takes a while to understand that.”

Debate and Discussion

So, what is the formula for an effective Board dynamic? How should a first-time Chair get the right mix of input and insight for balanced discussions where people are both talking and listening?

Bernie stated his preference is to check in with Board members before meetings take place to identify any important issues around strategy, business operations and governance. He first asks: "'What's front of your mind?' Is there anything important that isn't on the agenda that anybody wants to spend time on?"

The goal is to create open debate. “I've heard it said that it's a real failure if the CEO and CFO disagree at a Board meeting,that it should never happen,” said Bernie. “I think that’s utter nonsense. If that never happens in a five-year cycle, there's something wrong. It’s a balancing act, but you need real discussions.”

Every Chair will have to develop a style and approach that suits them. When discussing this, Bridget said: “There's a whole variety of beefy, ‘business as usual’ things that you've got to make sure are being properly managed. Once they’ve been addressed, it allows for time to deal with the strategic issues.”

The composition of the Board is another area to focus on. Ananth observed: “The Chair today needs to be very familiar with sustainability and climate change. They need to align the interests of management through compensation structures and dashboards. I think a Chair or at least somebody senior on the Board needs to be very familiar with these issues.”

Of course, every Chair will have their own take on tackling the Boardroom, how they tailor their role and what works for their organisation and its stakeholders, which is part of the appeal. Mark reflected: “It's a lot of fun. Being a portfolio Chair is brilliant because there are a variety of situations, many of which you can add value through the experience of your executive and non-exec career.”

By Emily Jones, Senior Editor, Criticaleye

If you’d like learn more about Criticaleye’s Chair-Ready Programme, please contact Justin Kennedy-Payne